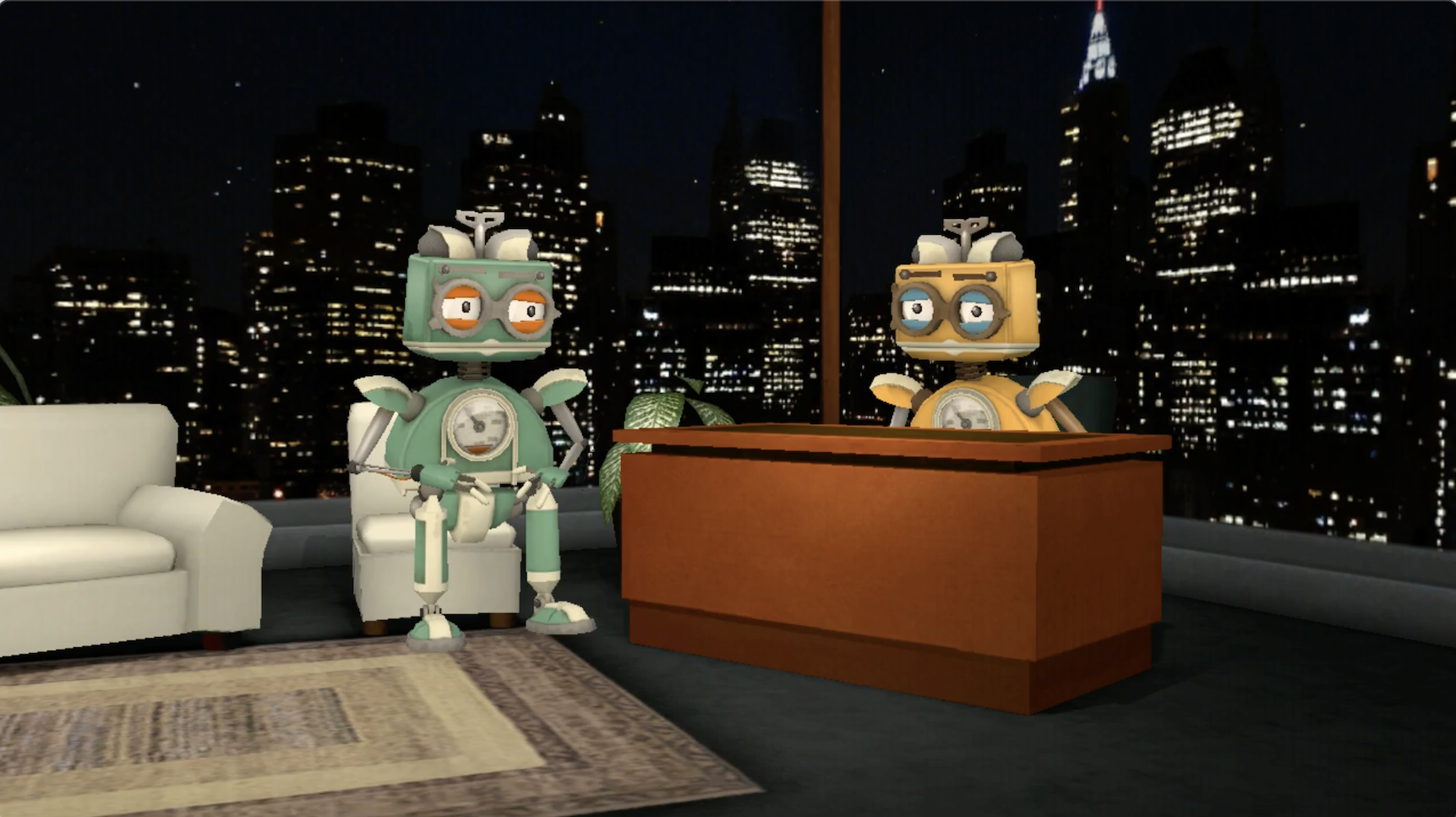

In the introduction to the Win/Loss Analysis in FinTech interview series, “It’s Not What You Think!”, we launched a discussion about topics including what is win/loss analysis, who it is for, why FinTech is different, and how to run an effective analysis program in that market. In this interview, Richard Case and I talk about blind interviews, including issues around…